Our First House

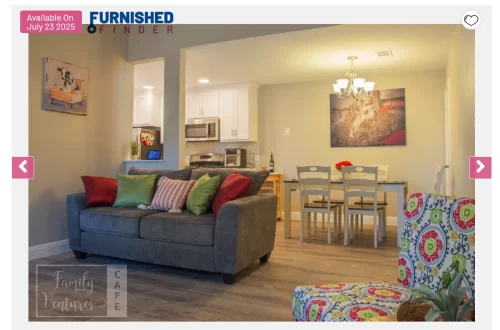

Round Rock – Single Family 1

We bought our first house after living in the United States for four years. It was a dream come true. As a young couple who had immigrated from a culture very different from the one in our original country, our primary goal was to secure good jobs that would allow us to own a house where we could raise our kids.

At that point, we were not thinking about owning real estate as a way to build wealth, nor had we considered achieving financial freedom. Even so, we managed to score some points thanks to basic Google research and tips such as:

- Look for a good area. Not expensive, good schools.

- Look for a house needing some TLC.

- Find a motivated seller (who might pay some of the closing costs or provide some consesions)

After a year of searching around the North Austin area, making offers, and facing rejections, we finally found our house. It was listed in June for $250K, which we initially overlooked because we thought it was too high-priced. A month later, the seller decreased the asking price by $10K.

The house had great bones, but the kitchen was not updated, the master bedroom had a worn-out carpet, and there was a wooden deck full of termites in the patio. We made an offer of $235K with $3000 paid by the seller towards our closing costs and won the deal. Long story short, the house has appreciated by almost $200K in three years. (We learned this is not normal, as the Austin Area had a huge spike in the housing price around 2020)

We bought the house with a conventional loan and only a 5% down payment, which we later refinanced, saving $300 a month on our mortgage.

At some point after the refinancing process, Arian came up with the idea of getting into real estate. Luckily for us, the Austin market was rapidly growing, and so were rent values, allowing us to rent the house, save $380 for repairs, cap expenses, vacancy, and other costs, while also earning $210 monthly in cash flow.

Tenants moved in on July 1st, and so far, there have been no issues with them.

This house holds a special place in our hearts as it was a huge milestone for two immigrants who had never owned a house before and were striving to achieve the American dream.

P.S. The dream got even bigger after this, but that is another story….

For those who like numbers

3 bed + studio – 2 bath – 1642 sqft

Purchase date: August 25, 2018

Purchase price: $235,000 with $3000 seller paid towards closing costs

Finance: Conventional 5% down payment – Interest rate 4.25%

Mortgage + taxes + insurance + PMI: Monthly cost: $1743

Biggest repairs done: Tile flooring in the master bedroom, quartz kitchen countertop, and concrete patio

Repairs approximated cost: $10,000

Refinance date: September 10, 2020

Refinanced amount: $216,000 (refinance costs included) – Rate: 2.99%

Mortgage + taxes + insurance: $1408

Monthly rent: $2000

ARV: $400K